|

| UPDATED: 2006-10-02 |

The Economist - Yahoo Stuck In Second  By: David Utter

By: David Utter 2006-10-02 In an industry where an overnight sensation can change one aspect of the online world, and just as quickly be surpassed by the next great thing, Yahoo and its CEO, Terry Semel, have been called out for running to stand still.  I see seven towers I see seven towers

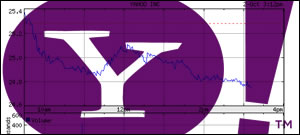

But I only see one way out You got to cry without weeping Talk without speaking Scream without raising your voice -- obligatory U2 reference Maybe the next time Bono swings through Sunnyvale to stop by Yahoo (YHOO) headquarters, he can break out the guitar and play the rest of the song. The Economist took the chairman and CEO and showed him the awful truth. The gap between Yahoo and high-flying Google has widened over just the past three months. The first expansion of the gap happened after Yahoo said its new advertising system would be delayed until 2007. Just recently, Yahoo disappointed analysts and Wall Street with the surprise disclosure that advertising revenue from financial and automotive clients had fallen. "We still expect to outgrow the segment in 2006. This is not about a tragedy or disaster; it's just pointing out something that we had seen," Semel said in the report. The article cited something others have seen, namely the slowdown with Yahoo isn't being reflected elsewhere: This week the Interactive Advertising Bureau and PricewaterhouseCoopers, a consultancy, jointly released the latest industry numbers, which show that online advertising in America grew by 37% to $7.9 billion, a new record, in the first half of the year.

Another firm that tracks online advertising, eMarketer, cut its forecasts, but that was in response to Mr Semel's statement. Jim Lanzone, the boss of Ask.com, the fourth-largest search engine after Google, Yahoo! and Microsoft's MSN, says that his firm is not seeing any similar easing of demand. One source quoted in the article described what might be called 'analysis paralysis' when it comes to deciding to do a deal at Yahoo. That seems surprising considering the number of deals Semel has greenlit, most recently the acquisition of Jumpcut. Yahoo may be simply managing risk, instead of tilting at the windmills of ever-increasing profits and stock value. The company wants to make money, of course, but maybe they are content to work at a different pace than others and keep their revenue stream steady instead of risking a big downturn after a huge uptick. Unlike Google, Yahoo has been through the first dot-com crash as a public company. Their IPO debuted in April 1996, two years after its founding, and a few years ahead of the big bubble going pop. It's an experience they may fear repeating. --- Tag: Yahoo Add to  Del.icio.us | Del.icio.us |  Digg | Digg |  Yahoo! My Web | Yahoo! My Web |  Furl Furl

Bookmark IFN -

|

|

||

Titan Quest Forum Titan Quest Forum |

Nintendo Wii Nintendo Wii |

Graphics Forum Graphics Forum |

Halo 3 Forum Halo 3 Forum |

Mac Software Mac Software |

|

| Latest News |

| InternetFinancialNews

is an iEntry, Inc. ® publication

© 1998-2007

All Rights Reserved. Privacy Policy - Crypto Casino Nederland - Legal - Sitemap - Contact Us - RSS Feeds |